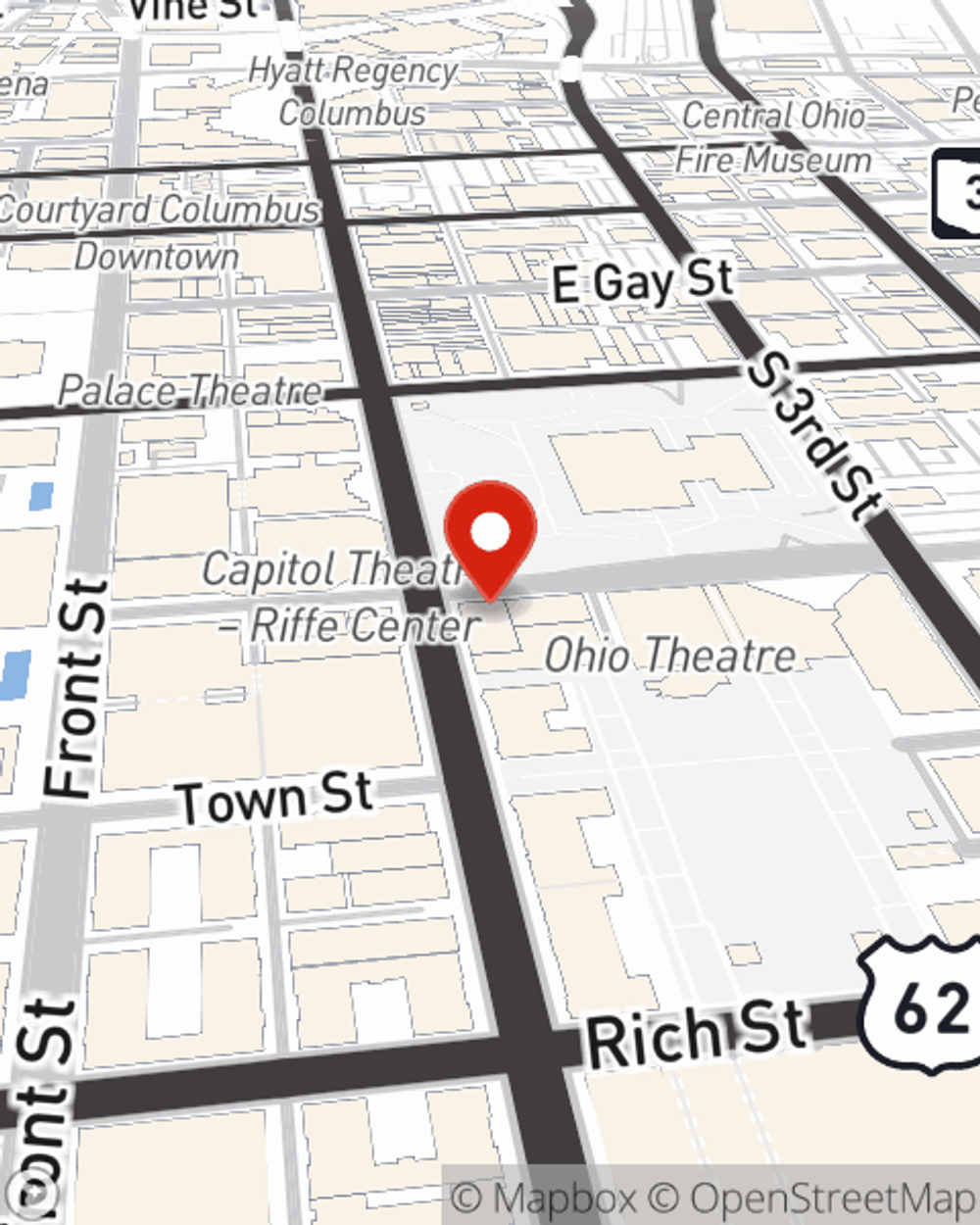

Business Insurance in and around Columbus

One of the top small business insurance companies in Columbus, and beyond.

This small business insurance is not risky

- Columbus

- Bexley

- German Village

- Italian Village

- Hilltop

- Short North

- Upper Arlington

- Victorian Village

- Olde Towne East

- Arena District

- Brewery District

- Berwick

- Clintonville

- Grandview

- Blacklick

- Dayton

- Reynoldsburg

- Pickerington

- Westerville

- Dublin

- Hilliard

- Gahanna

- Powell

Help Prepare Your Business For The Unexpected.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all alone. State Farm agent Nikki Ogunduyile, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of the top small business insurance companies in Columbus, and beyond.

This small business insurance is not risky

Insurance Designed For Small Business

Whether you are a real estate agent a photographer, or you own a shoe repair shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Nikki Ogunduyile can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and loss of income and extra expense.

At State Farm agent Nikki Ogunduyile's office, it's our business to help insure yours. Reach out to our wonderful team to get started today!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Nikki Ogunduyile

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.